Irs Schedule D 2024 Form – The Schedule D tax worksheet helps investors calculate certain kinds of investment income for the Schedule D form, including depreciated real estate. Schedule D Capital Assets The Schedule D form . Taxpayers will also have higher standard deductions in the 2024 tax year. It increases to $12,950 for single taxpayers and $29,200 for married couples. Unable to view our graphics? Click here to .

Irs Schedule D 2024 Form

Source : www.investopedia.com

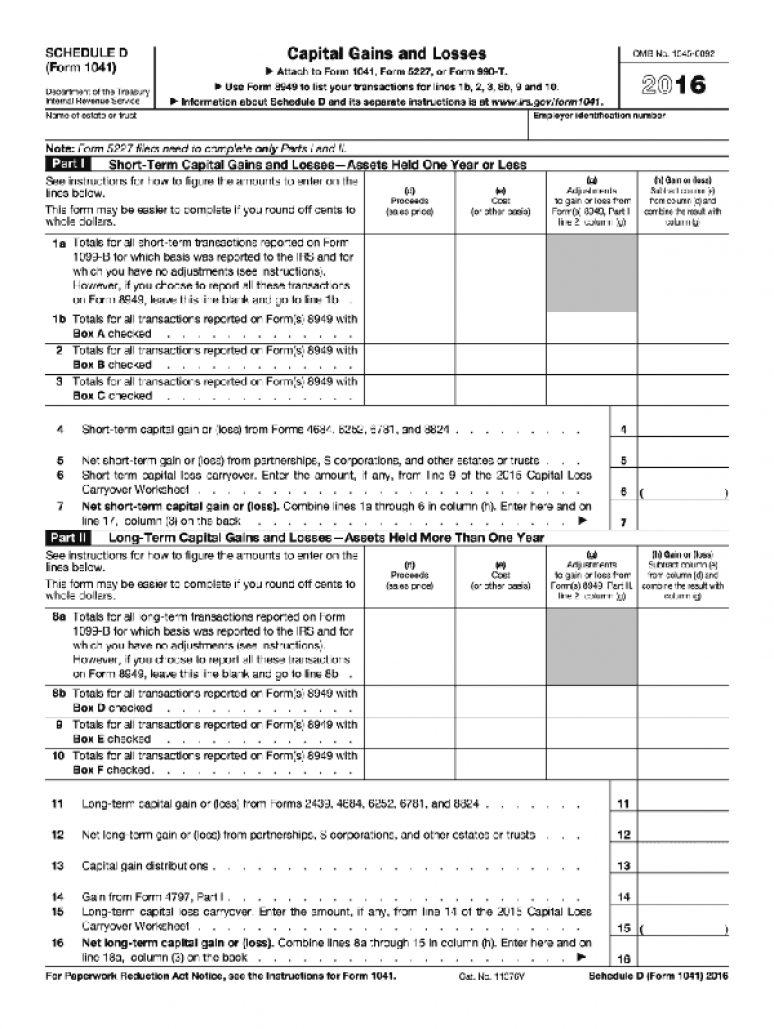

Capital Gains and Losses, IRS Tax Form Schedule D 2016 (Package of

Source : bookstore.gpo.gov

IRS Schedule D Walkthrough (Capital Gains and Losses) YouTube

Source : m.youtube.com

FinCEN Compliance – Summer 2023 BE 12 Reporting & Beneficial

Source : www.btcpa.net

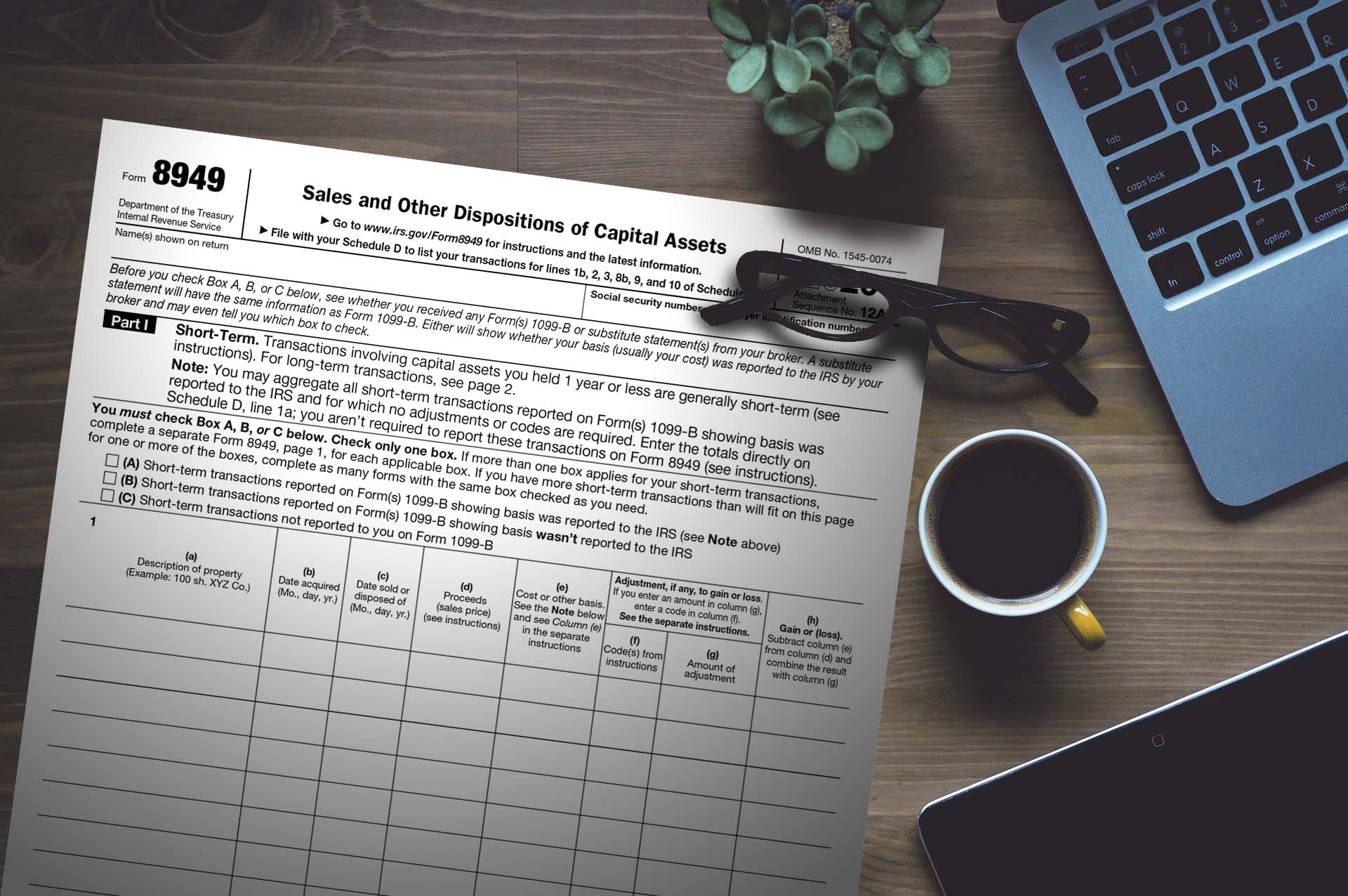

IRS FORM 8949 & SCHEDULE D TradeLog

Source : tradelog.com

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

Tax cap at two percent for 2024 | The River Reporter

Source : riverreporter.com

Articles of interest related to business accounting, INTERAC

Source : www.intersoftsystems.com

IRS moves forward with free e filing system in pilot program to

Source : www.fox13memphis.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

Irs Schedule D 2024 Form When Would I Have to Fill Out a Schedule D IRS Form?: The latest annual inflation adjustments report from the Internal Revenue Service (IRS) reveals modifications to income tax brackets and standard deductions for the upcoming 2024-2025 tax season. . The draft Form 941 removes remaining lines reporting Covid-19 federal tax credits The draft Schedule R can be filed with Form 941 or 941-X Drafts of Form 941 and its schedules to be used for all four .

:max_bytes(150000):strip_icc()/IRSScheduleD-c7be5030d7394773ad2d905654e9e902.png)